Renters Insurance in and around Oshkosh

Get renters insurance in Oshkosh

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Home Sweet Home Starts With State Farm

It may feel like a lot to think through your busy schedule, managing your side business, family events, as well as providers and savings options for renters insurance. State Farm offers hassle-free assistance and unmatched coverage for your furniture, clothing and electronics in your rented home. When mishaps occur, State Farm can help.

Get renters insurance in Oshkosh

Renting a home? Insure what you own.

There's No Place Like Home

You may be doubtful that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the house. How much it would cost to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when fires or break-ins occur.

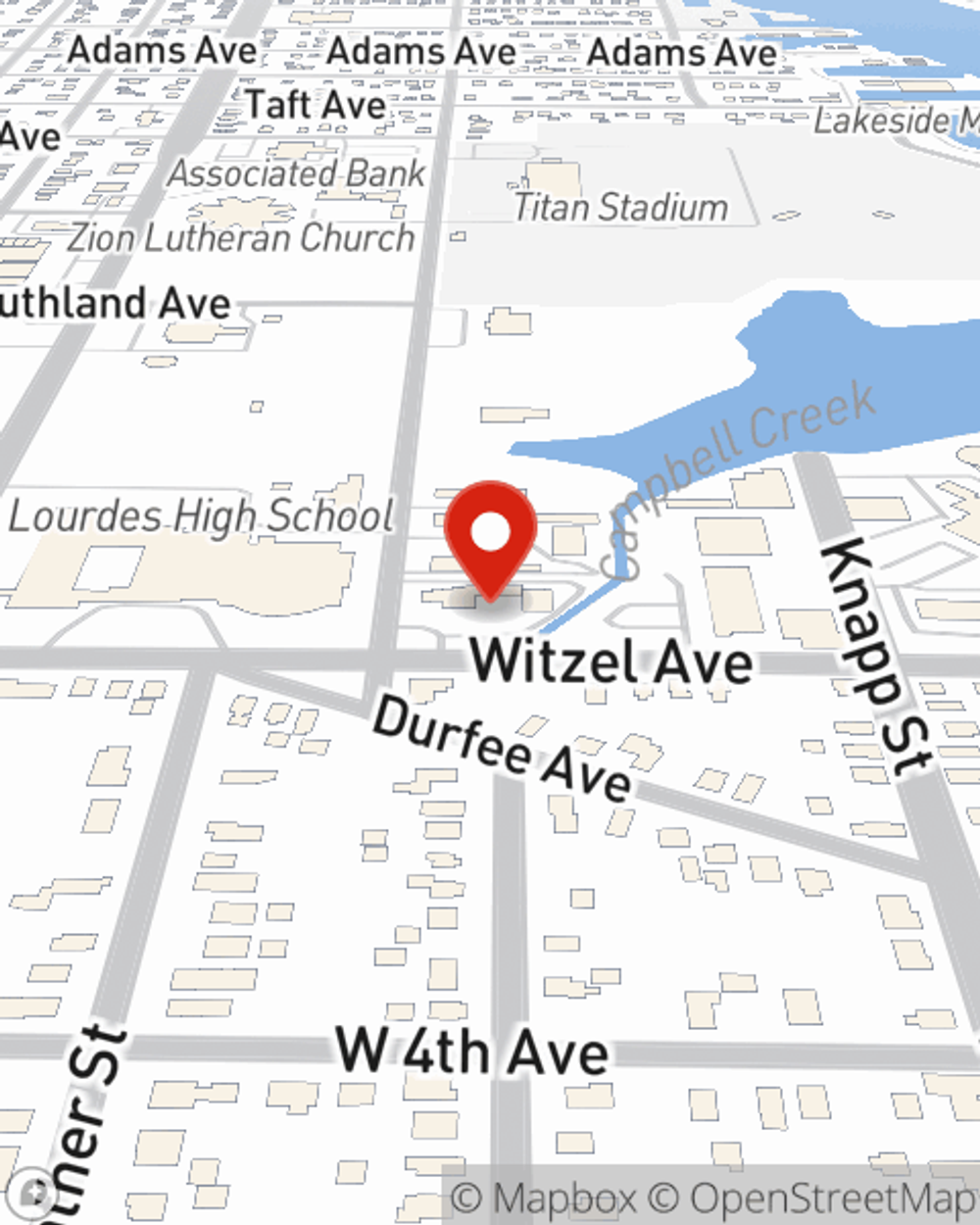

As a dependable provider of renters insurance in Oshkosh, WI, State Farm aims to keep your home safe. Call State Farm agent Lyndee Lewis today and see how you can save.

Have More Questions About Renters Insurance?

Call Lyndee at (920) 231-9710 or visit our FAQ page.

Simple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Lyndee Lewis

State Farm® Insurance AgentSimple Insights®

The ins and outs of moving insurance

The ins and outs of moving insurance

Moving insurance can help you stay covered and protect your move. Before you purchase moving insurance, read these basics.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.